- Jeep Cherokee Push Button Start Not Working: Troubleshooting Tips To Get You Back on the Road Fast! - 11 November 2023

- Haval H2 Problems: The Complete Troubleshooting Guide - 11 November 2023

- Gwm P Series Problems: Troubleshooting Guide for Common Issues - 11 November 2023

To determine if you have gap insurance, check your current car insurance policy or the terms of your lease or loan. Gap insurance is typically offered as optional coverage by insurers or as an additional add-on by dealers.

Before adding more coverage, it’s important to find out if you already have gap insurance.

Understanding Gap Insurance

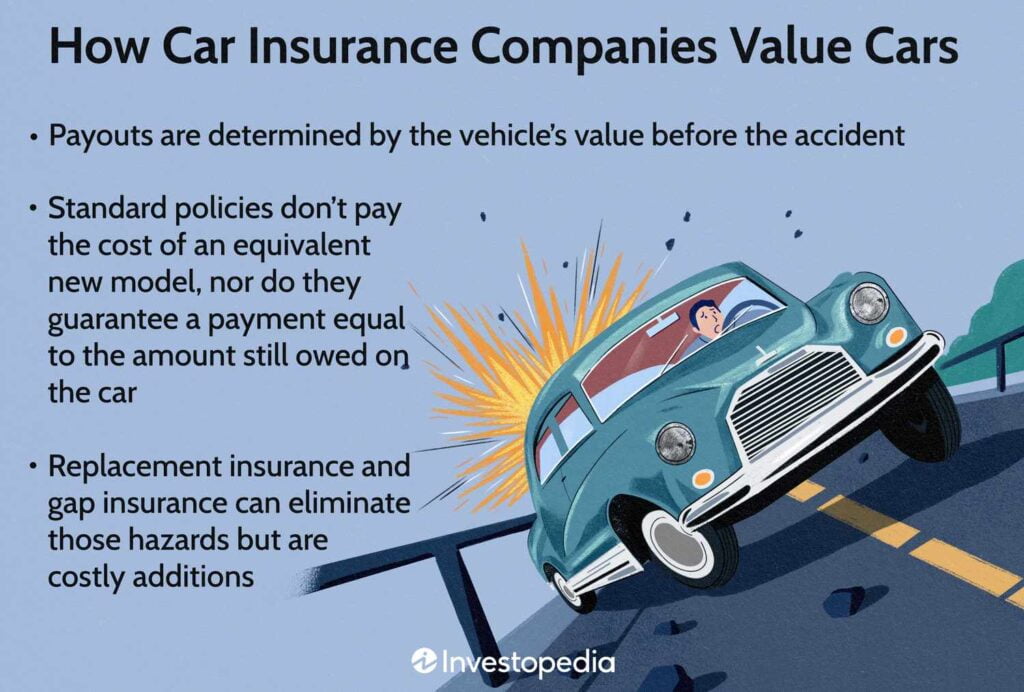

When it comes to insuring your vehicle, it’s essential to understand all the different types of coverage available to you. One type of coverage that you may have heard of but may not fully understand is gap insurance. Gap insurance, also known as Guaranteed Asset Protection insurance, is designed to cover the “gap” between the amount you owe on your car and its actual cash value in the event of a total loss.

What Is Gap Insurance?

Gap insurance is an optional coverage that is typically offered by insurers or as an add-on by car dealers. It protects you financially if your car is deemed a total loss due to theft or an accident. In such cases, your insurance company will typically only reimburse you for the actual cash value of your car, which may be significantly lower than the amount you owe on your loan or lease.

How Does Gap Insurance Work?

When you have gap insurance, it covers the difference, or the “gap,” between your loan or lease balance and the actual cash value of your car. For example, if your car is worth $20,000 according to your insurance company, but you still owe $25,000 on your loan, gap insurance would cover the $5,000 difference.

Why Do I Need Gap Insurance?

Gap insurance is particularly important if you have a loan or lease on your vehicle. Without gap insurance, you could find yourself still owing money on a car that you no longer have. This situation can create a significant financial burden, as you would be responsible for paying off the remaining balance of your loan or lease out of pocket.

Benefits Of Gap Insurance

There are several benefits to having gap insurance:

- Peace of mind knowing that you won’t be left with a financial burden if your car is declared a total loss.

- Protection from owing additional money on your loan or lease after your insurance payout.

- The ability to pay off your loan or lease, even if your car is deemed a total loss, allowing you to start fresh with a new vehicle.

Is Gap Insurance Mandatory?

Unlike liability insurance, which is typically mandatory, gap insurance is not required by law. However, many lenders and leasing companies may require you to have gap insurance as part of your loan or lease agreement. It’s important to check your loan or lease terms to see if gap insurance is mandatory for you.

In conclusion, gap insurance is an optional coverage that can provide valuable financial protection in the event of a total loss. It covers the difference between what you owe on your car and its actual cash value, so you don’t find yourself still owing money on a car you no longer have. While it’s not mandatory, it’s worth considering if you have a loan or lease on your vehicle to ensure you are fully protected.

Checking Your Current Car Insurance Policy

To determine if you have gap insurance, review your current car insurance policy or check the terms of your lease or loan. Gap insurance is typically offered as optional coverage by insurers or as an additional add-on by dealers, so it’s important to verify if you already have it before considering additional coverage.

How To Check If You Have Gap Insurance In Your Current Policy

If you’re unsure whether you have gap insurance in your current car insurance policy, there are a few steps you can take to find out. Start by checking your policy documents or reaching out to your insurance provider. Here’s what you need to do:- Review Your Policy Documents: Take the time to carefully read through your car insurance policy documents. Look for any mention of gap insurance or coverage for the “gap” between what you owe on your vehicle and its actual cash value. If you find this coverage listed, it means you have gap insurance.

- Contact Your Insurance Provider: If you couldn’t find any information about gap insurance in your policy documents, the next step is to contact your insurance provider directly. Speak with a representative and ask them specifically if you have gap insurance. They will be able to provide you with accurate information regarding your coverage.

- Check Your Insurance Statement: Another way to determine if you have gap insurance is by reviewing your insurance statement or bill. Look for any line items relating to gap coverage or additional protection for the “gap” between the value of your car and what you owe on your loan or lease. If you see this listed, it means you have gap insurance.

What To Look For In Your Policy Documents

- Coverage Description: Look for any descriptions or explanations of coverage that specifically mention gap insurance or the coverage of the “gap” between your car’s value and what you owe on it.

- Policy Endorsements: Check for any policy endorsements or add-ons that indicate the inclusion of gap insurance. These endorsements may be listed separately or bundled with other additional coverages.

- Policy Coverage Limits: Pay attention to the coverage limits mentioned in your policy. Gap insurance coverage limits can vary, so make sure to check if the coverage amount aligns with your needs.

Understanding The Coverage And Terms Of Gap Insurance

Once you have confirmed that you have gap insurance, it’s crucial to understand the specifics of your coverage. Here are some key details to consider:- Eligible Vehicles: Gap insurance typically covers leased or financed vehicles. Make sure to check if your policy specifies the type of vehicles covered.

- Coverage Period: Gap insurance is often valid for a specific period, such as the duration of your loan or lease. Check your policy to determine the length of coverage.

- Claim Process: Familiarize yourself with the steps involved in filing a gap insurance claim. Understand the documentation required and any deadlines for submission.

- Exclusions and Limitations: Be aware of any exclusions or limitations outlined in your policy. Certain factors, such as intentional damages or excessive wear and tear, may not be covered by gap insurance.

Reviewing The Terms Of Your Lease Or Loan Agreement

When it comes to knowing if you have gap insurance, reviewing the terms of your lease or loan agreement is a crucial step. Gap insurance is typically offered as an optional coverage by insurers or as an add-on by dealers. It provides coverage for the “gap” between what you owe on your vehicle and its actual cash value.

How To Identify Gap Insurance In Your Lease Or Loan Agreement

Identifying whether you have gap insurance in your lease or loan agreement is important. Here are some steps to help you determine if you have this coverage:

- Review the documents carefully: Start by thoroughly reviewing your lease or loan agreement. Look for any mention of gap insurance or a similar term.

- Check for specific coverage details: Look for any specific details regarding the coverage, such as the duration of coverage or any restrictions that may apply.

What To Look For In The Agreement Documents

When reviewing your lease or loan agreement for gap insurance, keep an eye out for the following:

- Insurance coverage section: Look for a section dedicated to insurance coverage. This is where you’re likely to find information about gap insurance.

- Specific terminology: Look for terms such as “gap insurance,” “loan lease payoff,” or any other similar phrases that indicate the presence of gap insurance.

- Coverage duration: Check if there is any mention of the duration of the gap insurance coverage. It’s important to know how long you’re protected.

- Cost information: Take note of any information regarding the cost of gap insurance. This can help you determine if you’re already paying for this coverage.

If you’re still uncertain about whether you have gap insurance or not, it’s always a good idea to reach out to your dealership or insurance provider for clarification. They can provide you with specific information about your coverage and help you understand your options.

Credit: www.tdi.texas.gov

Contacting Your Car Dealership

To determine if you have gap insurance, review your car insurance policy or the terms of your lease or loan. Gap insurance is typically offered as optional coverage by insurers or as an additional add-on by dealerships. It’s important to check if you already have gap insurance before considering additional coverage.

Speaking With Your Dealership To Confirm Gap Insurance

If you’re unsure whether or not you have gap insurance, one of the best ways to find out is by contacting your car dealership. They can provide you with the necessary information and confirm whether or not gap insurance is included in your lease or loan agreement.

Questions To Ask Your Dealership About Gap Insurance

When speaking with your dealership, consider asking the following questions to get a clear understanding of your gap insurance coverage:

- Is gap insurance included in my lease or loan agreement?

- If not, is it available as an optional add-on?

- What is the cost of adding gap insurance to my policy?

- What does the gap insurance policy cover?

- What are the claim procedures for gap insurance?

By asking these questions, you can ensure that you have a thorough understanding of the coverage provided by gap insurance and any additional costs or requirements.

Seeking Additional Coverage Options If Gap Insurance Is Not Included

If you discover that gap insurance is not included in your lease or loan agreement, it’s important to explore additional coverage options. Leaving the gap between your car’s value and what you owe can leave you financially vulnerable in the event of a total loss.

Consider reaching out to your car insurance provider to inquire about adding gap insurance to your policy. Many insurance companies offer it as an optional coverage that you can add for an additional premium.

Alternatively, you can explore independent gap insurance providers who specialize in offering this type of coverage. It’s important to compare quotes and coverage options to ensure you’re getting the best deal.

Remember, having gap insurance can provide you with peace of mind knowing that you won’t be responsible for paying the difference between what your car is worth and what you owe in the event of a total loss.

Assessing The Need For Gap Insurance

To determine if you have gap insurance, check your car insurance policy or the terms of your lease/loan. Gap insurance is typically optional coverage offered by insurers or as an add-on by dealers, so it’s important to find out if you already have it before considering additional coverage.

Factors To Consider When Deciding If Gap Insurance Is Necessary

Assessing the need for gap insurance is crucial for car owners, especially those who are financing or leasing their vehicles. While it may not be a mandatory requirement, understanding the factors involved can help you make an informed decision. Here are some key points to consider:

Evaluating The Risk Of Negative Equity

Negative equity occurs when the amount you owe on your car loan or lease exceeds the actual value of the vehicle. This can happen due to depreciation or if you rolled over negative equity from a previous car loan. If you find yourself in a situation of negative equity, having gap insurance can provide you with financial protection. It covers the “gap” between the outstanding loan amount and the actual cash value of your car in case of a total loss.

Understanding The Effects Of Depreciation On Car Value

One crucial aspect to consider when assessing the need for gap insurance is the impact of depreciation on your car’s value. As soon as you drive a new car off the lot, it starts to lose value due to wear and tear, market conditions, and other factors. Over time, the car’s worth can significantly decrease, leading to a potential gap between the loan amount and the actual cash value. Gap insurance can safeguard you from the financial burden of this depreciation.

By understanding these factors, you can make an informed decision about whether or not to invest in gap insurance. It is important to note that each individual’s situation will vary, so it’s essential to assess your own circumstances before making a final choice.

Frequently Asked Questions For How Do I Know If I Have Gap Insurance

How Do I Know If I Have Gap Insurance On My Loan?

To find out if you have gap insurance on your loan, check your car insurance policy or the terms of your lease or loan agreement. Gap insurance is typically offered as optional coverage by insurers or as an add-on by dealers.

It’s important to verify if you already have gap insurance before adding more coverage.

How Long Does Gap Insurance Take To Kick In?

Gap insurance usually takes effect immediately after you purchase it. It provides coverage for the “gap” between your car’s value and what you owe on your loan or lease. To know if you have gap insurance, check your car insurance policy, lease or loan terms.

How To Figure Cost Of Gap Insurance?

To figure out the cost of gap insurance, subtract your car’s current actual cash value from your remaining auto loan balance. The result is the amount of coverage you’ll need. Gap insurance is typically offered as optional coverage by insurers or as an add-on by dealers, so check your current car insurance policy or the terms of your lease or loan to see if you already have it.

Is Loan Lease Payoff The Same As Gap Insurance?

Loan lease payoff and gap insurance are not the same. Loan lease payoff covers the remaining balance on your loan or lease if your vehicle is totaled or stolen, while gap insurance covers the “gap” between your vehicle’s actual cash value and the amount you owe on your loan or lease.

It’s important to have both types of coverage for complete protection.

What Is Gap Insurance And Why Do I Need It?

Gap insurance covers the difference between what you owe on your car and its actual cash value. It’s important because it can save you from owing money on a totaled or stolen car.

Conclusion

To determine if you have gap insurance, start by reviewing your car insurance policy or the terms of your lease or loan. Gap insurance is typically offered as optional coverage by insurers or as an add-on by dealerships. It’s important to verify if you already have gap insurance before considering additional coverage.

If you’re unsure, you can contact your insurer or review your purchase agreement. Understanding gap insurance and its benefits can help you make an informed decision about your coverage needs.