- Jeep Cherokee Push Button Start Not Working: Troubleshooting Tips To Get You Back on the Road Fast! - 11 November 2023

- Haval H2 Problems: The Complete Troubleshooting Guide - 11 November 2023

- Gwm P Series Problems: Troubleshooting Guide for Common Issues - 11 November 2023

Yes, you need auto insurance to buy a car, as most car dealerships won’t allow you to leave with the car unless it’s insured first. Having the minimum amount of liability insurance that meets your state’s requirements is essential for driving the car home.

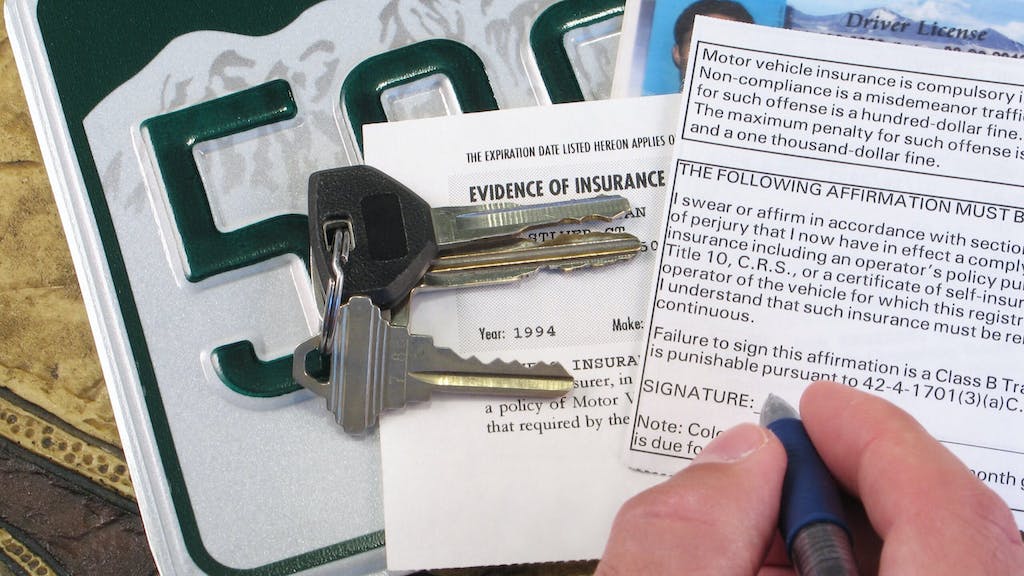

When purchasing a car, it’s important to have all the necessary documents in order. This includes your driver’s license, proof of auto insurance, and financing documents if applicable. Experts also recommend getting preapproved for a car loan, which requires current proof of residence, proof of income, and your credit score.

Additionally, each state has different regulations regarding the grace period for obtaining insurance after buying a new or used car, so it’s crucial to research and adhere to these guidelines. Remember, driving without insurance is not only illegal but also exposes you to significant financial risk in the event of an accident.

Credit: www.expertins.net

Understanding The Importance Of Car Insurance

Buying a car without insurance is technically possible, but it’s important to note that you will need auto insurance before you can drive it home. Most car dealerships require you to have insurance that meets your state’s minimum liability coverage before you can leave with the car.

The Significance Of Car Insurance For Vehicle Owners

Car insurance plays a crucial role in protecting vehicle owners from a wide range of potential risks and financial liabilities. It is designed to provide coverage for damages or injuries that may occur as a result of accidents or unforeseen events. Having car insurance ensures that you are financially protected in case of any unfortunate incident, such as theft, accidents, or damage caused to your vehicle or someone else’s property. It offers peace of mind and a sense of security, knowing that you are financially safeguarded.

The Role Of Car Insurance In Protecting Yourself And Others On The Road

Car insurance not only protects you and your vehicle but also others who may be involved in the accident. In the event of a collision, car insurance helps cover the medical expenses of any injured parties, including pedestrians or passengers in other vehicles. It also provides coverage for any damage caused to other vehicles, properties, or infrastructure. By having car insurance, you are not only protecting yourself but also fulfilling your ethical and legal responsibility towards other road users.

Why Car Insurance Is A Legal Requirement In Most States

Car insurance is a legal requirement in most states to ensure the safety and financial protection of all road users. It enforces responsibility and accountability among vehicle owners, making sure that they are prepared to handle any potential damages or injuries caused by their vehicles. The legal requirement for car insurance helps maintain the stability of the insurance industry and ensures that all drivers contribute to a collective fund that can be used to compensate anyone affected by accidents or collisions. It is essential to be aware of the specific car insurance requirements in your state to avoid any legal consequences.

Minimum Liability Insurance: A Must-have

When it comes to purchasing a car, one important factor to consider is insurance. Technically, you can buy a vehicle without insurance. However, to drive it home, you need to have a minimum amount of liability insurance that meets your state’s legal requirements. In fact, most car dealerships won’t even allow you to leave with the car unless it’s insured first.

Exploring The Concept Of Minimum Liability Insurance

Minimum liability insurance is a type of auto insurance coverage that provides financial protection for damages or injuries caused by your vehicle. This insurance typically covers the other party involved in an accident, rather than yourself or your vehicle. It is a fundamental and mandatory requirement in most states, ensuring that all drivers have at least a basic level of coverage.

Understanding The Coverage Provided By This Type Of Insurance

Minimum liability insurance offers coverage for damages or injuries caused to others in an accident where you are at fault. This includes expenses related to medical bills, property damage, and legal fees. It is important to note that this insurance does not provide any coverage for your own vehicle or personal injuries.

Here is an overview of what minimum liability insurance typically covers:

- Third-party bodily injury coverage

- Third-party property damage coverage

- Legal fees and defense costs

The Legal Requirements For Minimum Liability Insurance In Various States

In the United States, each state has its own legal requirements for minimum liability insurance coverage. The specific coverage limits and types may vary, so it is essential to familiarize yourself with the laws in your state to ensure compliance.

Here is a table summarizing the minimum liability insurance requirements in select states:

| State | Bodily Injury Coverage (per person/per accident) | Property Damage Coverage |

|---|---|---|

| California | $15,000/$30,000 | $5,000 |

| Texas | $30,000/$60,000 | $25,000 |

| Florida | $10,000/$20,000 | $10,000 |

| New York | $25,000/$50,000 | $10,000 |

It is important to note that these are just examples, and you should consult your state’s official website or an insurance professional to determine the exact requirements in your area.

In conclusion, minimum liability insurance is a must-have when buying a car. It provides essential financial protection for damages or injuries caused to others in accidents where you are at fault. By understanding the coverage provided and complying with your state’s legal requirements, you can ensure that you have the necessary insurance coverage before driving your new car home.

Car Dealerships And Insurance Requirements

When buying a car, insurance is typically required by most car dealerships before you can drive the vehicle home. While technically you can purchase a car without insurance, the dealership may not allow you to leave without proof of coverage.

It’s important to have a policy that meets your state’s minimum liability insurance requirements.

The Dealership’s Perspective On Car Insurance

From a dealership’s perspective, there are a few key reasons why they require insurance prior to allowing you to drive off with a car. First and foremost, insurance provides protection for both the dealership and the buyer in the event of an accident or damage to the vehicle. Dealerships want to ensure that their assets are protected, and having insurance coverage helps to minimize potential liabilities.

Moreover, insurance also serves as a safeguard against potential financial loss. Car dealerships invest a significant amount of money in their inventory, and they need to ensure that their vehicles are protected from any potential damages or accidents that may occur during the test drive or after the purchase. By requiring insurance, dealerships can mitigate the financial risks associated with these situations.

Why Most Car Dealerships Require Insurance Prior To Driving Off With A Car

One of the main reasons why car dealerships require insurance prior to driving off with a car is to protect their own interests. As mentioned earlier, dealerships invest a significant amount of money in their inventory and vehicles, and they need to ensure that their assets are adequately safeguarded. By requiring insurance, dealerships can rest assured that they will be compensated for any damages or accidents that may occur during the time the car is in the buyer’s possession.

Additionally, requiring insurance provides peace of mind for both parties involved. For the buyer, having insurance coverage means that they are protected from financial loss in the event of an accident or damage to the vehicle. They can drive off the dealership lot with confidence knowing that they are covered by their insurance policy.

Ensuring Compliance With Dealership Insurance Policies

To ensure compliance with dealership insurance policies, it is essential for buyers to provide proof of insurance before driving off with a car. This documentation serves as evidence that the buyer has the necessary coverage in place to protect the vehicle and themselves in case of an accident or damage.

Dealerships typically have specific requirements regarding the minimum amount of liability insurance coverage that buyers must carry. It is crucial for buyers to review their state’s insurance requirements and ensure that they meet or exceed the minimum requirements set by the dealership. Failure to comply with these insurance policies may result in the buyer being unable to drive the car off the lot.

Therefore, before heading to the dealership, buyers should contact their insurance provider to obtain the necessary documentation and confirm that their policy meets the dealership’s insurance requirements. This proactive approach ensures a smooth and hassle-free car buying experience.

Financing A Car: Insurance Considerations

When buying a car, insurance is typically required before driving it off the lot. Most car dealerships won’t allow you to leave with the car unless it’s insured first, ensuring you have the minimum amount of liability insurance required by your state.

the importance of having insurance before finalizing the purchase. When financing a car, insurance considerations play a crucial role in protecting both the car owner and the lender. Understanding how financing affects car insurance requirements is essential for a smooth and hassle-free purchasing experience.# How financing affects car insurance requirementsWhen purchasing a car with financing, it’s important to note that the lender holds a financial interest in the vehicle. As a result, they require the buyer to maintain a certain level of insurance coverage to protect their investment. This means that the insurance requirements when purchasing a car with a loan are typically more stringent compared to buying a car outright.# Insurance requirements when purchasing a car with a loanTo ensure that their investment is adequately protected, lenders usually require comprehensive and collision coverage in addition to the state’s minimum liability insurance. Comprehensive and collision coverage provide financial protection in case of damage or loss to the vehicle due to accidents, theft, or natural disasters. This requirement ensures that both the buyer and the lender are protected financially.Moreover, lenders may also require the buyer to carry a specific deductible amount. The deductible is the amount the buyer needs to pay out of pocket before the insurance coverage kicks in. Lenders often set a higher deductible, reducing their risk in case of a claim.# The importance of having insurance before finalizing the purchaseIt is crucial to have insurance coverage in place before finalizing the purchase of a financed car. Without insurance, not only will you be in violation of the lender’s requirements, but you will also be taking a significant financial risk. In the event of an accident or loss, you would be responsible for all repairs or replacement costs out of pocket.Furthermore, car dealerships typically do not allow buyers to leave with the car unless it is insured first. This policy ensures that the car is protected from the moment it leaves the lot. Therefore, it is essential to have proof of insurance before completing the purchase.In conclusion, when financing a car, insurance considerations are crucial. Understanding how financing affects car insurance requirements and having insurance in place before finalizing the purchase are vital steps to protect both the buyer and the lender. Make sure to consult with your insurance provider and discuss the necessary coverage options to meet the lender’s requirements and ensure a smooth purchasing experience.(Note: The content above is written in HTML format and does not include any specific code or formatting. Please convert it to the desired HTML format before posting it on a WordPress blog.)Grace Period For Insurance Coverage

When buying a car, you technically can do so without insurance, but you’ll need it to drive the vehicle home. Most dealerships require proof of insurance before allowing you to leave with the car, ensuring that you have the minimum amount of liability coverage required by your state.

The Concept Of A Grace Period For New Car OwnersWhen purchasing a new car, one of the important considerations is insurance coverage. While auto insurance is mandatory for driving a car, there is often a grace period provided for new car owners. This grace period is a specified duration during which the new car owner can delay obtaining insurance coverage without facing penalties or consequences. |

Understanding The Duration And Limitations Of The Grace PeriodThe duration of the grace period can vary depending on the state and the insurance provider. It can range anywhere from a few days to a few weeks. However, it’s important to note that the grace period is not a free pass to drive without insurance indefinitely. During the grace period, new car owners should be proactive in obtaining insurance coverage as soon as possible. The limitations of the grace period typically include restrictions on coverage, such as only providing liability insurance and excluding comprehensive and collision coverage. It’s crucial to understand these limitations and assess whether additional coverage is required based on your individual needs and preferences. |

The Importance Of Obtaining Insurance Within The Grace PeriodWhile the grace period offers temporary relief, it’s essential to prioritize obtaining insurance coverage within this timeframe. Driving without insurance can expose you to significant financial risks in the event of an accident or damage to your vehicle. Additionally, it is illegal in most states to operate a vehicle without the minimum required insurance coverage. Getting insurance within the grace period ensures that you are protected and complies with legal requirements. It also allows you to explore different insurance options, compare quotes, and select the best policy that provides adequate coverage at a reasonable cost. |

Frequently Asked Questions For Do You Need Insurance To Buy A Car

Do I Need Insurance First To Buy A Car?

Yes, you need insurance before buying a car. While it is technically possible to purchase a vehicle without insurance, most dealerships require proof of insurance before you can drive the car off the lot. Additionally, you need auto insurance to legally drive the car on the roads, meeting your state’s minimum liability insurance requirements.

What Do I Need Before Buying A Car?

Before buying a car, you will need a valid driver’s license, proof of auto insurance, and financing documents if applicable. It is also recommended to get preapproved for a car loan, which requires proof of residence, income, and credit score.

In some cases, car dealerships may not allow you to leave with the car unless it is insured first.

How Long Do You Have To Get Insurance On A New Car In Illinois?

In Illinois, you need to get insurance on a new car before driving it home. Most car dealerships require proof of insurance before you can leave with the car.

How Long Do You Have To Get Insurance After Buying A Used Car In Az?

After buying a used car in AZ, you should get insurance right away. It is recommended to have auto insurance before driving the car home. Most car dealerships require proof of insurance before allowing you to leave with the car.

Can You Buy A Car Without Insurance?

Technically, you can buy a vehicle without insurance. However, most car dealerships won’t allow you to leave with the car unless it’s insured first.

Conclusion

To legally drive your newly purchased car home, you need to have auto insurance that meets your state’s minimum requirements of liability coverage. Most car dealerships will not allow you to leave with the car unless it’s insured. While technically you can buy a vehicle without insurance, it’s highly recommended to get coverage as soon as possible.

So, make sure to have your insurance ready before purchasing a car to ensure a smooth and legal ownership process. Stay protected on the road!