- Jeep Cherokee Push Button Start Not Working: Troubleshooting Tips To Get You Back on the Road Fast! - 11 November 2023

- Haval H2 Problems: The Complete Troubleshooting Guide - 11 November 2023

- Gwm P Series Problems: Troubleshooting Guide for Common Issues - 11 November 2023

If a stolen car is found after an insurance payout, the insurance company becomes the owner and can sell the car. It is important to file a claim with the insurance company if your car is stolen, as long as you have comprehensive coverage.

However, if the claim has already been paid and the car is later recovered, it becomes the property of the insurance company. They may choose to sell the car if it is in good condition. This process is followed to ensure that the insurance company recovers some of the money they paid out for the stolen vehicle.

Understanding The Insurance Claim Process For A Stolen Car

When it comes to dealing with the unfortunate event of a stolen car, understanding the insurance claim process is crucial. If your car has been stolen, the first step is to file a claim with your insurance company. By doing so, you can initiate the process of recovering your losses.

One of the key considerations when it comes to filing an insurance claim for a stolen car is the type of insurance policy you have. Comprehensive insurance is the coverage that is often required to protect against theft. This type of insurance covers not only theft but also other perils such as damage caused by natural disasters, vandalism, and accidents involving animals. Having comprehensive insurance coverage ensures that you are protected in case of a car theft.

The insurance company plays a crucial role in processing your claim for a stolen car. Once you have filed the claim, the insurance company will assess the details and evidence provided. This may involve gathering information from the police report, conducting investigations, and verifying the ownership of the vehicle. The insurer will also review your policy to determine the coverage limits and deductibles that apply.

If the claim is approved, the insurance company will typically pay you the actual cash value of your stolen car. It’s important to note that this may not necessarily be the same amount you initially paid for the vehicle, as depreciation will be taken into account.

Now, what happens if your stolen car is found after the insurance company has already paid out your claim? In such cases, it’s important to understand that the vehicle now belongs to the insurance company. They have the right to sell it if the car is in good condition. On the other hand, if the claim has been submitted but not yet processed, you retain ownership of the car, even if it is recovered.

It’s crucial to notify your insurer immediately if your stolen vehicle is found. This allows them to adjust their records accordingly and take the necessary steps. Additionally, if you have purchased a new car with the insurance payout, your old vehicle now belongs to the insurance company, regardless of its recovery.

In conclusion, understanding the insurance claim process for a stolen car is essential for car owners. By filing a timely claim, having comprehensive insurance coverage, and cooperating with your insurance company, you can navigate the process with confidence and ensure that your losses are duly compensated.

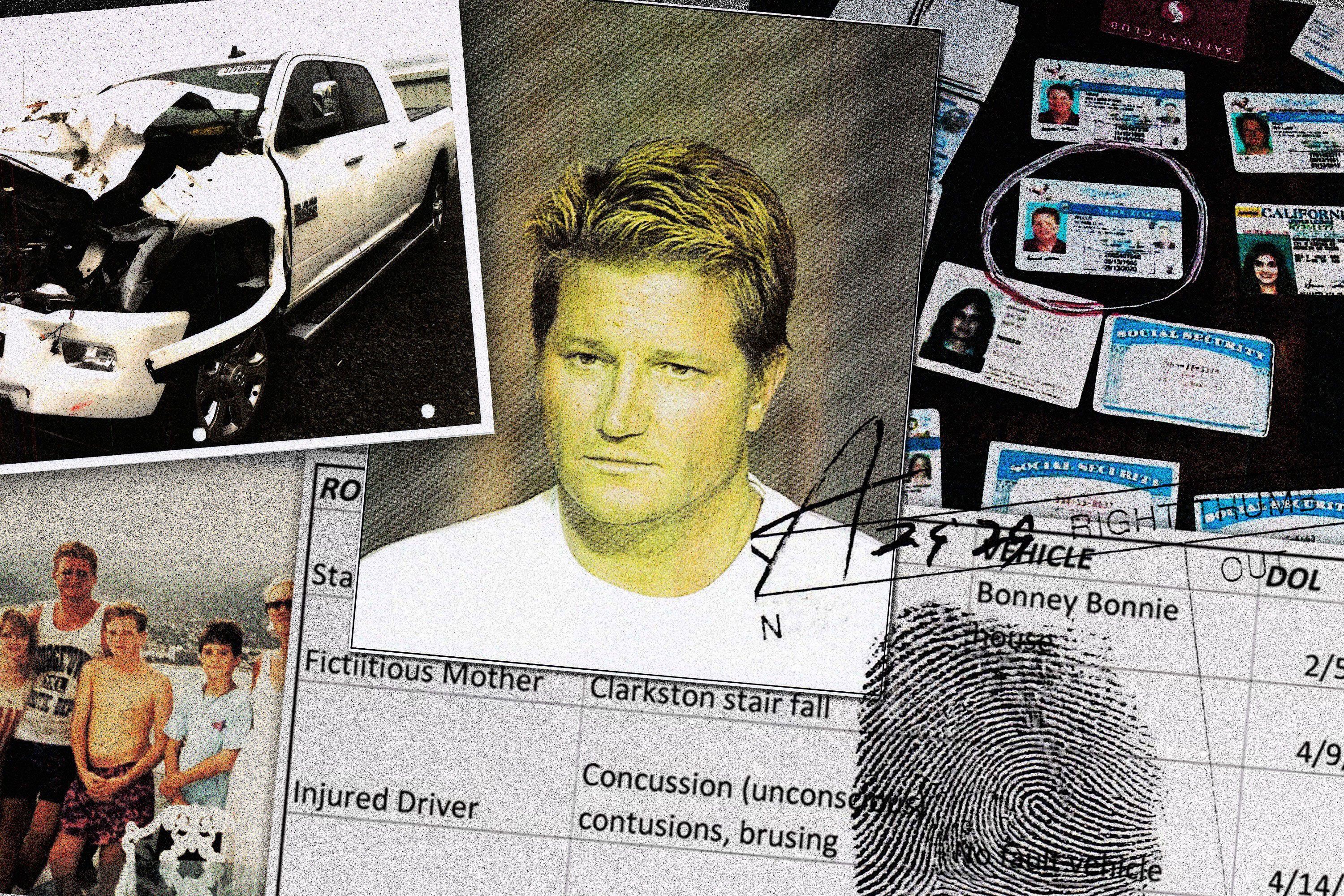

Credit: nymag.com

The Status Of A Stolen Car After Insurance Payout

When your car is stolen and you file a claim with your insurance company, comprehensive coverage typically covers the theft. If the car is later recovered after the insurance claim has been paid, it becomes the property of the insurance company. This raises questions about what happens to the stolen car and whether the insurance company can sell it. Let’s explore the different scenarios and factors that determine the fate of a recovered stolen vehicle.

Insurance Company Ownership Of A Stolen Car After A Settlement

If your insurance company has paid the claim for your stolen car and it is later found, they become the new owners of the vehicle. Once the insurance company has settled the claim and issued payment, they assume control over the recovered car. This is an important aspect to consider as it affects the actions the insurance company can take with the vehicle.

Possibility Of The Insurance Company Selling The Recovered Car

Now that the insurance company owns the recovered stolen car, one possibility is that they may sell it if it is in good condition. This is commonly done to mitigate their costs and recover some of the money paid out for the claim. Selling the car can help offset the loss incurred by the insurance company and potentially reduce the financial impact on their business.

Factors Determining The Fate Of The Recovered Vehicle

The fate of a recovered stolen car is determined by several factors. Firstly, the condition of the vehicle plays a crucial role. If the car is in good condition, the insurance company is more likely to find a buyer and sell it. Additionally, the age, make, and model of the car can influence their decision. Newer cars or popular models may have a higher resale value, making them more attractive for sale.

Moreover, the local laws and regulations regarding salvage vehicles and their reselling also play a significant role. Insurance companies need to comply with these laws and follow proper procedures when selling recovered stolen cars. They may have to obtain salvage titles or provide certain disclosures to prospective buyers.

In conclusion, once your stolen car has been recovered after the insurance claim has been paid, it becomes the property of the insurance company. They have the option to sell the vehicle if it is in good condition and can recover some of the costs associated with the claim. Several factors such as the condition of the car and local laws influence the fate of the recovered vehicle. It’s important to be aware of these possibilities and understand the actions the insurance company can take with the car.

Legal Implications And Responsibilities For The Insurance Company

If a stolen car is found after an insurance payout, the insurance company becomes the owner of the vehicle and has the right to sell it if it’s in good condition. The policyholder should immediately notify the insurer and follow their instructions.

Legal Rights And Responsibilities Of The Insurance Company

When a stolen car is found after an insurance payout, there are several legal implications and responsibilities that the insurance company must adhere to. Let’s take a closer look at their legal rights and responsibilities in such a scenario.Obligations To Inform The Insured About The Recovered Car

Once the insurance company becomes aware that the stolen car has been recovered, they have an obligation to inform the insured about the situation. It is their responsibility to notify the policyholder promptly and provide them with all the relevant details regarding the recovered vehicle.Potential Consequences For Not Complying With Legal Requirements

Failure to comply with the legal requirements and responsibilities surrounding a recovered stolen car can have significant consequences for the insurance company. They can face legal penalties, fines, and even potential lawsuits from the insured if they fail to inform them about the recovered vehicle or unlawfully dispose of it without the policyholder’s knowledge or consent.To summarize, the insurance company must uphold their legal rights and responsibilities when a stolen car is found after an insurance payout. This includes notifying the insured about the recovered car and ensuring compliance with all legal requirements. Failure to do so can lead to serious consequences for the insurance company.Options For The Insured After Insurance Payout And Car Recovery

Options for the Insured after Insurance Payout and Car Recovery

Actions To Take If The Insurance Claim Has Not Been Processed

If your stolen car is recovered before the insurance claim has been processed, it is crucial to take immediate actions to protect your rights and ensure a smooth insurance process. Here are some steps you can take:

- Notify your insurance company: Inform your insurance company about the recovery of your stolen car. Provide them with all the necessary details, including the date, time, and location of the recovery.

- Cooperate with the investigation: Work closely with the authorities and your insurance company during the investigation process. Provide any additional information or documentation they may require to support your claim.

- Document the condition of the vehicle: Take photographs and gather evidence of the current condition of your recovered car. This documentation will be valuable during the claim assessment process.

- Follow up with your insurance company: Stay in touch with your insurance company to track the progress of your claim. Be proactive in providing any requested information or documentation to ensure a speedy resolution.

Rights Of Ownership If The Claim Has Not Gone Through

If your insurance claim has not been processed at the time your stolen car is recovered, you retain ownership of the vehicle. However, it’s crucial to consult with your insurance company to understand their specific policies and procedures regarding recovered stolen vehicles. They may require additional documentation or inspections to verify the condition of the car before finalizing the claim.

Considerations For Purchasing A New Vehicle After A Payout

Once you have received an insurance payout for your stolen car, you may be considering purchasing a new vehicle. Here are a few important considerations to keep in mind:

- Determine your budget: Assess your financial situation and determine how much you can afford to spend on a new car. Consider factors such as down payment, monthly payments, and insurance costs.

- Research different options: Take the time to research different makes and models that fit your needs and preferences. Compare prices, features, and customer reviews to make an informed decision.

- Visit multiple dealerships: Visit several dealerships to explore different options and negotiate the best deal. Don’t hesitate to ask questions and take test drives to ensure the vehicle meets your expectations.

- Consider purchasing from a reputable dealer: Buying from a reputable dealer can provide you with additional peace of mind and support should any issues arise with your new vehicle.

- Review insurance coverage: Contact your insurance company to update your coverage for your new vehicle. Compare quotes from different insurers to ensure you are getting the best rates and coverage.

By following these steps and considering these factors, you can navigate the process after your stolen car is recovered and make informed decisions regarding your insurance claim and purchasing a new vehicle.

What Happens To The Stolen Car If It Is Recovered After Settlement

When a stolen car is recovered after an insurance payout, there are several important factors to consider. Let’s take a closer look at what happens to the stolen car, the rights and actions of the insurance company, possible scenarios for the disposition of the recovered vehicle, and the implications for the insured and potential compensation options.

Insurance Company Rights And Actions After The Stolen Car Is Recovered

Once the stolen car has been recovered after the insurance settlement, it becomes the property of the insurance company. They have the right to take possession of the vehicle and determine its future course of action. In most cases, the insurance company will assess the condition of the car and decide whether to sell it or salvage it for parts to recoup their expenses. It’s important to note that the insurance company’s actions are within their rights as outlined in the insurance policy.

Possible Scenarios For The Disposition Of The Recovered Vehicle

There are a few different scenarios that can occur when a stolen car is recovered after an insurance payout. Firstly, if the car is found to be in good condition and deemed suitable for resale, the insurance company may choose to sell it. This allows them to recover some of the money they paid out for the claim. Alternatively, if the car is not in good condition or is considered a total loss, the insurance company may opt to salvage it. This means that the car will be dismantled and sold for parts. Salvaging the car helps the insurance company recoup some of their losses and reduces the risk of potential future issues with the vehicle.

Implications For The Insured And Potential Compensation Options

For the insured, the recovery of the stolen car after the insurance settlement may have some implications. Firstly, if the car is in good condition and the insurance company decides to sell it, there is a possibility of receiving additional compensation. The insurance company may provide a portion of the proceeds from the sale of the car to the insured as a form of reimbursement. However, it’s important to remember that this is not always guaranteed and will depend on the terms of the insurance policy. It’s recommended to consult with the insurance company to understand the potential compensation options available.

In conclusion, when a stolen car is recovered after an insurance payout, the insurance company takes ownership of the vehicle. They have the right to determine the future course of action, which can include selling the car or salvaging it for parts. The insured may have the potential for additional compensation if the car is sold, but this will depend on the terms of the insurance policy. It’s important for the insured to communicate with the insurance company to understand their rights and options in these situations.

Frequently Asked Questions For What Happens If Stolen Car Is Found After Insurance Payout

What Happens If Stolen Goods Are Recovered After Insurance Claim?

If stolen goods are recovered after an insurance claim, you have the option to keep the recovered property. However, you must return the payment to your insurance carrier. The insurance company will cover the expenses for the recovery and repairs, up to the Limit of Insurance.

They determine the value of the stolen goods based on the replacement cost minus depreciation.

How Does An Insurance Company Determine The Value Of A Stolen Car?

Insurance companies determine the value of a stolen car by calculating the actual cash value (ACV). The ACV takes into account the replacement cost of the vehicle minus depreciation, including factors like age and wear and tear.

Faq 1: What Happens If My Stolen Car Is Found After The Insurance Payout?

If your stolen car is recovered after the insurance payout, the car becomes the property of the insurance company.

Faq 2: What Should I Do If My Stolen Car Is Found After The Insurance Claim?

If your stolen car is recovered after the insurance claim, you should immediately notify your insurer.

Faq 3: Can I Refuse To Take Back My Stolen Car If It’s Found After The Insurance Payout?

No, if your stolen car is found after the insurance payout, the car now belongs to the insurance company.

Conclusion

If your stolen car is found after your insurance payout, the car becomes the property of the insurance company. They have the option to sell it if it is in good condition. However, if the claim has not yet been processed, you still retain ownership of the car.

It is important to immediately notify your insurer if your stolen vehicle is recovered. Remember, the insurance company determines the value of the stolen car based on factors like age and depreciation.